The most common question our office has heard this past year has been “Does Homeowners Insurance Cover Wildfires”? Homeowners Insurance in California does cover damage to your home in the event of a wildfire. A standard homeowners policy, also known as an HO-3, provides coverage for certain perils, including fire.

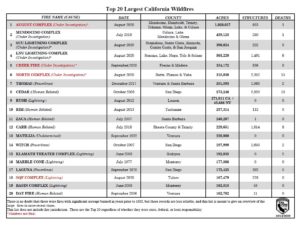

For California homeowners, wildfires have unfortunately been a major problem these past 4 years. The 2020 fire season in California resulted in a year of record-setting wildfires that burned across the entire state. With over 9,600 fires and 4 million acres burned, 2020 ended as the largest wildfire season in Californias modern history.

It is important to understand what types of fire losses are and are not covered under a standard homeowners policy.

What Wildfire Damage Is And Is Not Covered By a Homeowners Insurance Policy In California?

A common questions that comes up is “Does homeowners insurance cover wildfires and house fires”? Whether it be a kitchen fire or a wildfire, fires are a covered peril under your home insurance policy. Unlike the perils of earthquake and flood, you do not need to purchase a separate fire insurance policy. The amount of coverage you have after a fire will depend on your policy limits for building coverage, personal property, other structures, and loss of use.

Fire damage can also be covered when it is caused by a peril that is not covered by your home insurance. For instance, if there was an earthquake that started a fire in your house your home insurance would provide you with coverage for the fire loss.

Arson is not only something that will land you in serious legal trouble but you can expect that your home insurance is not going to provide you with any coverage. If one day you intentionally start a fire in your home in hopes for a big insurance payout, your claim is going to be denied and you may be facing criminal charges.

What If You Cannot Obtain Regular Home Insurance In California Because You Live In A Wildfire Zone?

Many California homeowners have had to face the harsh reality that comes with owning a home in a high fire risk area. Non-renewals, cancellations, and not being able to obtain insurance in the admitted market has become all too common these past few years.

These customers have placed their home insurance with the California Fair Plan. The Fair plan was created as a last resort insurance option for customers who can not obtain insurance with an admitted carrier. Fair Plan customers are typically individuals whose properties are located in areas with high wildfire risk.

Does Homeowners Insurance Cover Wildfires With The California Fair Plan?

Yes. The Fair Plan provides coverage for fire, lightening, smoke, internal explosion and then provides the option to add extended coverages like wind, hail, vandalism ,etc.

The issue with the Fair plan policies is it will not provide you with personal liability coverage, medical payments, coverage for theft, falling objects, water damage, etc. You would need to purchase a DIC(difference in conditions) policy in order to get coverage for those types of losses.

It is in your best interest to find an independent agent who has access to multiple carriers and products who can check around the market for you and see if they cannot find you an admitted or non admitted carrier.

Homeowners Insurance is our specialty.

At Don Williams and Associates we have access to a wide range of property insurance carriers. If your property is not eligible with an admitted or non-admitted carrier, we can put together a package for you with the Fair Plan if need be.

Give us a call today at 408-402-3646 or fill out this form and one of our wildfire insurance experts will be able to assist you!